CBSE Class 12 Accountancy Sample Paper 2023-24

Click here to Download Accountancy-SQP

CBSE Accountancy Class 12 Sample Paper 2024: Find here the sample question paper of CBSE Accountancy for class 12 candidates going to appear for the 2023-2024 board examination. Also download the PDF of the sample paper along with its marking scheme or solution. Also check the CBSE Class 12 Accounts additional practice questions published by CBSE board for board exams 2024.

the 2023-2024 board examination. Also download the PDF of the sample paper along with its marking scheme or solution. Also check the CBSE Class 12 Accounts additional practice questions published by CBSE board for board exams 2024.

General Instructions:

This question paper contains 34 questions. All questions are compulsory.

This question paper is divided into two parts, Part A and B.

Part – A is compulsory for all the candidates.

Part – B has two options i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options as per the subject opted.

Question Nos.1 to 16 and 27 to 30 carries 1 mark each.

Questions Nos. 17 to 20, 31and 32 carries 3 marks each.

Questions Nos. from 21 ,22 and 33 carries 4 marks each

Questions Nos. from 23 to 26 and 34 carries 6 marks each

There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, 1 question of four marks and 2 questions of six marks.

PART A (Accounting for Partnership Firms and Companies)

1 A& B are partners sharing profits and losses in the ratio of 3:2. C is admitted for ¼ and for which ₹30,000 and ₹10,000 are credited as a premium for goodwill to A and B respectively. The new profit- sharing ratio of A:B:C will be:

a) 3:2:1

b) 12:8:5

c) 9:6:5

d) 33:27:20

2 Assertion: Batman, a partner in a firm with four partners has advanced a loan of ₹50,000 to the firm for last six months of the financial year without any agreement. He claims an interest on loan of ₹3,000 despite the firm being in loss for the year.

Reasoning: In the absence of any agreement / provision in the partnership deed, provisions of Indian Partnership Act, 1932 would apply.

a) Both A and R are correct, and R is the correct explanation of A.

b) Both A and R are correct, but R is not the correct explanation of A.

c) A is correct but R is incorrect.

d) A is incorrect but R is correct.

3 If 10,000 shares of ₹10 each were forfeited for non-payment of final call money of ₹3 per share and only 7,000 of these shares were re-issued @₹ 11 per share as fully paid up, then what is the minimum amount that company must collect at the time of re-issue of the remaining 3,000 shares?

a) ₹ 21,000

b) ₹ 9,000

c) ₹ 16,000

d) ₹ 30,000

OR

On 1st April 2022, Galaxy ltd. had a balance of ₹8,00,000 in Securities Premium account. During the year company issued 20,000 Equity shares of ₹10 each as bonus shares and used the balance amount to write off Loss on issue of Debenture on account of issue of 2,00,000, 9% Debentures of ₹100 each at a discount of 10% redeemable @ 5% Premium. The amount to be charged to Statement of P&L for the year for Loss on issue of Debentures would be:

a) ₹30,00,000.

b) ₹22,00,000.

c) ₹24,00,000.

d) ₹20,00,000.

4 A, B and C who were sharing profits and losses in the ratio of 4:3:2 decided to share the future profits and losses in the ratio to 2:3:4 with effect from 1st April 2023. An extract of their Balance Sheet as at 31st March 2023 is:

| Liabilities | Amount(₹) | Assets | Amount(₹) |

| Workmen Compensation Reserve | 65,000 |

At the time of reconstitution, a certain amount of Claim on workmen compensation

was determined for which B’s share of loss amounted to₹5,000. The Claim for workmen compensation would be:

a) ₹15,000

b) ₹70,000

c) ₹50,000

d) ₹80,000

OR

A, B and C are in partnership business. A used ₹2,00,000 belonging to the firm without the information to other partners and made a profit of ₹35,000 by using this amount. Which decision should be taken by the firm to rectify this situation?

a) A need to return only ₹2,00,000 to the firm.

b) A is required to return ₹35,000 to the firm.

c) A is required to pay back ₹35,000 only equally to B and C.

d) A need to return ₹2,35,000 to the firm.

5 Interest on Partner’s loan is credited to:

a) Partner’s Fixed capital account.

b) Partner’s Current account.

c) Partner’s Loan Account.

d) Partner’s Drawings Account

6 Alexa Ltd. purchased building from Siri Ltd for ₹8,00,000. The consideration was paid by issue of 6% debentures of ₹100 each at a discount of 20%. The 6% Debentures account is credited with:

a) ₹10,40,000

b) ₹10,00,000

c) ₹9,60,000

d) ₹6,40,000

OR

Which of the following statements is incorrect about debentures?

a) Interest on debentures is an appropriation of profits.

b) Debenture holders are the creditors of a company.

c) Debentures can be issued to vendors at discount.

d) Interest is not paid on Debentures issued as Collateral Security.

7 Assertion (A) :- A Company is Registered with an authorised Capital of 5,00,000 Equity Shares of ₹10 each of which 2,00,000 Equity shares were issued and subscribed. All the money had been called up except ₹2 per share which was declared as ‘Reserve Capital’. The Share Capital reflected in balance sheet as ‘Subscribed and Fully paid up’ will be Zero.

Reason ( R ) :- Reserve Capital can be called up only at the time of winding up of the company.

(a) Both Assertion (A) and Reason (R) are Correct and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are Correct, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is incorrect, but Reason (R) is Correct.

(d) Assertion (A) is correct, but Reason (R) is incorrect

8 G, S and T were partners sharing profits in the ratio 3:2:1. G retired and his dues towards the firm including Capital balance, Accumulated profits and losses share, Revaluation Gain amounted to ₹ 5,80,000. G was being paid ₹ 7,00,000 in full settlement. For giving that additional amount of ₹ 1,20,000, S was debited for ₹ 40,000. Determine goodwill of the firm.

a). ₹ 1,20,000

b). ₹80,000

c). ₹2,40,000

d). ₹ 3,60,000

OR

Annu, Banu and Chanu are partners, Chanu has been given a guarantee of minimum profit of ₹8,000 by the firm. Firm suffered a loss of ₹5,000 during the year. Capital account ofBanu will be ________ by₹_________.

a) Credited, ₹6,500.

b) Debited, ₹6,500.

c) Credited, ₹1,500.

d) Debited, ₹1,500.

Read the following hypothetical situation, answer question no. 9 and 10.

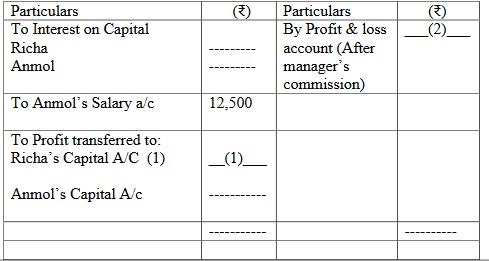

Richa and Anmol are partners sharing profits in the ratio of 3:2 with capitals of ₹2,50,000 and ₹1,50,000 respectively. Interest on capital is agreed @ 6% p.a. Anmol is to be allowed an annual salary of 12,500. During the year ended 31st March 2023, the profits of the year prior to calculation of interest on capital but after charging Anmol’s salary amounted to ₹62,000.A provision of 5% of this profit is to be made in respect of manager’s commission.

Following is their Profit & Loss Appropriation Account

9 The amount to be reflected in blank (1) will be:

a) ₹37,200

b) ₹44,700

c) ₹22,800

d) ₹20,940

10 The amount to be reflected in blank (2) will be:

a) ₹62,000.

b) ₹74,500.

c) ₹71,400.

d) ₹70,775.

11 In the absence of an agreement, partners are entitled to:

i) Profit share in capital ratio.

ii) Commission for making additional sale.

iii) Interest on Loan & Advances by them to the firm.

iv) Salary for working extra hours.

v) Interest on Capital.

Choose the correct option:

a) Only i), iv) and v).

b) Only ii) and iii).

c) Only iii).

d) Only i) and iii).

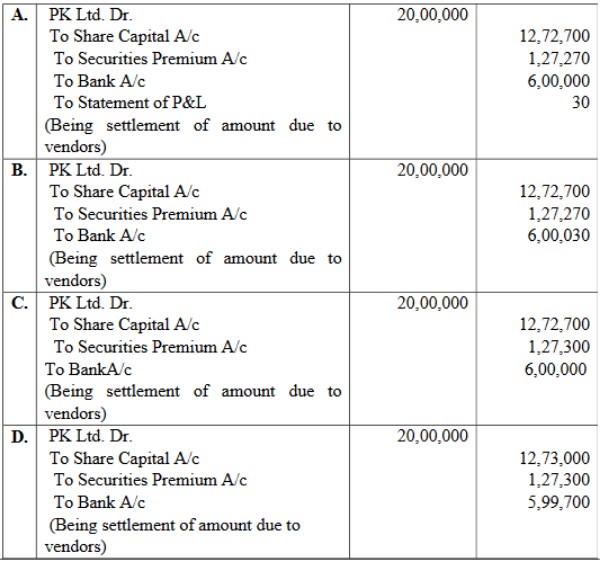

12 Rancho Ltd. took over assets worth ₹ 20,00,000 from PK Ltd. by paying 30% through bank draft and balance by issue of shares of ₹ 100 each at a premium of 10%. The entry to be passed by Rancho Ltd for settlement will be :-

13 A company forfeited 3,000 shares of ₹10 each, on which only ₹5 per share (including ₹1 premium) has been paid. Out of these few shares were re-issued at a discount of ₹1 per share were and ₹6,000 were transferred to Capital Reserve. How many shares were re-issued?

a) 3,000 shares

b) 1,000 shares

c) 2,000 shares

d) 1,500 shares

14 X and Y are partners in a firm with capital of ₹18,000 and ₹20,000. Z brings ₹10,000 for his share of goodwill and he is required to bring proportionate capital for 1/3rdshare in profits. The capital contribution of Z will be:

a) ₹24,000.

b) ₹19,000.

c) ₹12,667.

d) ₹14,000.

15 A and B are partners. B draws a fixed amount at the end of every quarter. Interest on drawings is charged @15% p.a. At the end of the year interest on B’s drawings amounted to ₹9,000. Drawings of B were:

a) ₹24,000 per quarter.

b) ₹40,000 per quarter

c) ₹30,000 per quarter

d) ₹80,000 per quarter

OR

Shyam, Gopal & Arjun are partners carrying on garment business. Shyam withdrew ₹ 10,000 in the beginning of each quarter. Gopal, withdrew garments amounting to ₹ 15,000 to distribute it to flood victims, and Arjun withdrew ₹ 20,000 from his capital account. The partnership deed provides for interest on drawings @ 10% p.a. The interest on drawing charged from Shyam, Gopal & Arjun at the end of the year will be

a) Shyam- ₹ 4,800; Gopal- ₹ 1,000; Arjun- ₹ 2,000.

b) Shyam- ₹ 4,800; Gopal- ₹ 1,000; Arjun- ₹ 2,000.

c) Shyam- ₹ 2,500; Gopal- ₹ 750; Arjun- Nil.

d) Shyam- ₹ 4,800; Gopal- Nil; Arjun- Nil.

16 On the day of dissolution of the firm ‘Roop Brothers’ had partner’s capital amounting to ₹1,50,000, external liabilities ₹35,000, Cash balance ₹8,000 and P&LA/c(Dr.) ₹7,000. If Realisation expense and loss on Realisation amounted to₹5,000 and ₹25,000 respectively, the amount realised by sale of assets is:

a) ₹1,64,000

b) ₹1,45,000

c) ₹1,57,000

d) ₹1,50,000

…

…

…